Encountering a disagreement with your insurance company can be a frustrating experience. But, by following a methodical approach, you can increase your chances of achieving a favorable outcome. Start by carefully reviewing your policy documents to understand your coverage. Document all communication with the insurance company, including dates, times, and names of individuals you speak with. Should you are incapable to resolve the dispute amicably, explore obtaining legal advice. A qualified attorney more info can guide you through the legal process and fight on your behalf.

- Maintain detailed records of all relevant information, including communication, invoices, together with any other supporting evidence.

- Comprehend your policy's terms and provisions to determine your entitlements.

- Communicate with the insurance company in a professional and respectful manner.

Navigating Your Insurance Claim: Strategies for Success

Securing a successful payment from your insurance claim can feel like navigating a labyrinth. Don't stress! By following these key tips, you can boost your chances of a positive conclusion. First and foremost, meticulously review your policy details. Familiarize yourself with the provisions regarding your coverage extent and the procedure for filing a claim. Swiftly report any incident to your insurance company, providing them with detailed information about the event.

Keep detailed records of all interactions with your insurer, including dates, times, and participants involved. Document any damage or injuries relevant to your claim. This evidence will be crucial in proving your case.

Consider reaching out to an experienced insurance specialist. They can guide you through the process, negotiate your best interests, and help confirm a fair outcome. Remember, being assertive and well-informed is essential for winning a successful insurance claim.

Avoid Insurance Rejections

Dealing with an insurance company that's giving you the runaround can be incredibly frustrating. But don't throw in the towel! You have options and there are steps you can take to get the benefits you deserve.

First, make sure your documentation is impeccable. Compile all relevant documents and send them in a timely manner. If your initial claim is denied, don't get discouraged. Carefully review the reason for the denial and see if there are any inaccuracies you can address.

Then, consider reviewing the decision. You may want to seek advice from an insurance lawyer who can help you navigate the procedure. Remember, persistence and preparedness are key to winning insurance company pushback.

Understanding Your Policy and Rights in an Insurance Dispute

Navigating an insurance dispute can be a complex process. It's crucial to thoroughly review your agreement documents to comprehend the terms, conditions, and coverage limits that apply to your situation.

Your policy will outline the specific circumstances under which your insurer is obligated to provide coverage. It's also important to become yourself with your legal rights as an insured party. These rights may include the ability to appeal a denial of coverage or seek a formal review of your claim.

If you encounter difficulties understanding your policy or believe your rights have been infringed, it's advisable to seek advice an qualified insurance advocate. They can help you in deciphering your policy language and consider available options to resolve the dispute.

Resolving Issues with Your Insurer

When disputes arise with your insurance provider, clear and concise communication is paramount. Start by carefully reviewing your policy documents to comprehend your coverage and any relevant exclusions. Record all interactions with the insurance company, including dates, times, names of representatives, and summary. When contacting the provider, remain composed and respectful. Clearly state your concerns in a logical manner, providing supporting evidence where applicable. Be determined in seeking a fair resolution. If you encounter difficulty resolving the issue directly with the provider, consider escalating your case to their customer service department or an independent insurance ombudsman.

Common Insurance Claim Pitfalls and How to Avoid Them

Filing an insurance claim can be a complicated process, and navigating it successfully requires careful attention to detail. There are many common pitfalls that claimants often run into, which can lead to delays or even denials. To ensure a smooth claims process, it's essential to recognize these potential problems and take steps to avoid them.

One frequent mistake is submitting an incomplete application. Be sure to provide all the necessary information and documentation, as missing details can result in your claim being put on hold. It's also crucial to report your insurer about any changes to your circumstances promptly. Failure to do so could void your coverage and leave you unprotected in case of a future event.

Another common pitfall is overstating the extent of your losses. While it's understandable to want to receive full reimbursement, being dishonest about damages can result serious consequences. Your insurer has ways to verify claims, and any discrepancies will likely lead to a denied claim or even legal action.

Remember, honesty and frankness are key when dealing with insurance claims. By avoiding these common pitfalls and following best practices, you can increase your chances of a successful outcome.

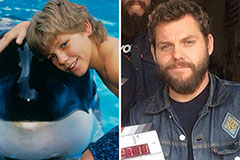

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now!